Vietnam’s oil and gas industry is currently the country’s biggest foreign currency earner and a major procurer of imported technology. Since the Dung Quat refinery has been operated in 2009, Vietnam has produced approximately 30 million tones crude oil, meeting 30% the demand of energy. Besides, oil and gas industry contributes 28-30% to Vietnam’s State budget every year

The oil and gas industry in Ba Ria- Vung Tau has enormous potential to grow in recent years that accounts for 93% of national oil reserve and 16% of national natural gas reserve.

The services for oil and gas industry in Ba Ria- Vung Tau have been evolved into a highly diversity such as exploration, extraction, process of petroleum products, supply of safety equipment, training… through large number of industrial parks has been established to serve this industry.

Vietnam – one of the fastest growing nations in Asia with more than 6% annual economic growth for the past 25 years has successfully increase its electrification rate from 54% to 98% since 1990; connecting some 55m people. It is one of the country’s priorities in providing secure and affordable supply of energy to all of the society participant and economic sectors at the same time, attract the capital required to expand infrastructure, securing the needed supply which are forecasted to hit 230TWH in 2020, 350TWH in 2025 and 515TWH in 2030.

In the revised Power Development Plan VII (PDP 7), released in 2017, installed power-generation capacity in Vietnam amounts to 42.13 GW, of which 37.6 percent is hydropower and 34.3 percent is coal-fired thermal power. It also sets out $148 billion worth of investments to increase power generation and develop the electricity network, with $40 billion to be spent in the period 2016-2020, of which 75 percent is to be directed to power sources and 25 percent to grid development.

There are two major groups in Viet Nam: Petro Viet Nam Power under Petro Viet Nam manage plants like Vung Ang PP, Nhon Trach PP, Ca Mau PP ..and Electricity Viet Nam ( EVN ) included Genco 1, Genco 2, Genco 3 manage many plants in Viet Nam like Nghi Son 1 PP, Duyen Hai PP, Quang Ninh PP, Uong Bi PP ….The remaining is in the form of BOT ( Build-Operate-Transfer) which is a form of contracts between a private company and the government.

Vietnam’s total oil refining capacity will nearly quadruple by 2023 as two new refineries go on stream.

The Dung Quat refinery in the central province of Quang Ngai operated by the state-owned PetroVietnam’s subsidiary Binh Son Refinery Limited (BSR) remains the sole facility now, with a crude oil processing capacity of 148,000 barrels per day (b/d).

Dung Quat will soon be joined by Nghi Son refinery in the central Thanh Hoa Province. Nghi Son is currently operating at full capacity.

The $9 billion Nghi Son project is owned by the Nghi Son Refinery and Petrochemical LLC (NSRP), a joint venture between Petro Vietnam, Kuwait Petroleum, Japan’s Idemitsu Kosan and Mitsui Chemical. It will have a designed capacity of 200,000 b/d of crude oil.

Meanwhile, the long-delayed construction of the Long Son refining and petrochemical complex in the southern province of Ba Ria-Vung Tau resumed this year, putting it on track to go on stream by the first half of 2023.

The fertilizer industry in Vietnam is fragmented with local players dominating 72% of the market. The top five players constitute around 28% of the market, based on the overall Vietnam fertilizers market revenue in 2018. Fertilizer industry in the country operates with the government involvement to protect domestic producers and farmers. Dealer system, regional company system, and definitive purchase are the most popular distribution channels in the country.

Major companies:

Binh DIen Fertilizer JSC

Southern Fertilizer JSC

PetroVietnam Fertilizer and Chemical Corp: Phu My Fertilizer & Ca Mau Fertilizer

Ninh Binh Phosphate Fertilizer JSC

Vietnam is considered to be one of the region’s most attractive markets for foreign investors with a steadily increasing GDP and booming foreign direct investment, a pattern which is forecasted to remain stable in the upcoming years. The nominal GDP in 2016 is estimated to reach €189.4 billion, recording a y-o-y growth rate of 6.2%. The country’s GDP is forecasted to attain €295.4 billion in 2020.

With a forecasted annual growth rate of 6% to 2020, the beverage industry in Vietnam is amongst the highest growth fast-moving consumer goods industries. Beverage consumption is estimated to reach 81.6 billion litres in 2016 with an outlook to reach 109 billion litres in 2020. Though receiving a humble compound annual growth rate (CAGR) of 3.5% until 2020, the beer sector in Vietnam is considered to have immense opportunities for investment as the country’s consumption is in the top 10 of Asian region and has a favourable per capita consumption at 42 litres in 2020. Wine and spirits and nonalcoholic drinks sectors are also forecasted to have an 8%- and 6.1%-CAGR respectively.

The country’s recent move to middle income level along with rising consumer affluence (GDP per capita is estimated to reach nearly €2,000 in 2016 and is forecasted to accelerate to over €2,800 in 2020) have accelerated the premiumisation momentum in the beverage industry. Vietnamese consumers are shifting towards consumption of beverages with higher value, creating gaps for penetration to upperclass beverage segments. Though both local and foreign players have attempted to act in response to this shift, overseas companies are currently at edge due to the favourability of using international brands of Vietnamese consumers.

Besides an improvement in demographic profile, it should be noted that Vietnamese consumers are the most health-conscious in Southeast Asia, calling for manufacturers to start rethinking market offerings which calibrate towards healthier product portfolio such as fruit juices or herbal teas. Ongoing development of the tourism industry and retailing network in Vietnam also act as catalysts for the growth of beverage industry as they create further demands for high-end drink segments as well as enhance the availability of beverage product lines via modern trade channels

The market for Industrial water and waste treatment is expected to register growth as it has gained fresh momentum due to enhanced focus of the government. Demand for industrial water and waste water treatment industry in Vietnam will be largely driven by increased concern for environment and lack of good quality water for industrial uses. The rivers are polluted and water must be treated before putting it to any use. Similarly discharging effluent in the open creates a lot of problem in the surrounding areas which has long term health impact prompting local to protest against setting up industries. The government also has shown its concern and has announced multiple investment projects in wastewater treatment to ensure treatment of water before being discharged. Plans of the government to make Vietnam a manufacturing hub will further boost the demand for water treatment plants in new and upcoming industries. Expansion of current capacity and upgradation of existing facilities with better, improved and efficient system will further boost the market.

Southern part of the country is fast emerging as the major destination for industrial water and waste water treatment industry. Upcoming manufacturing unit and increased participation of the private sector in developing manufacturing capacity in provinces adjoining Hanoi and Ho Chi Minh cities have contributed to the growth in water treatment sector. Power and Textile sector along with agro based food processing is expected to drive the market in the region.

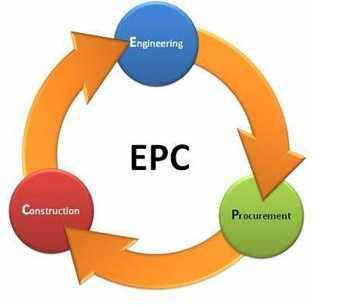

EPC providing integrated design and engineering, procurement of machinery & equipment, and construction for industrial and process plants, mainly in field of chemical, petrochemical, oil and gas, fertilizer, pharmaceutical, food and beverage, utility, environment and energy industries in Viet Nam market & oversea.